FIRST EFFECTS OF THE MUSK-TWITTER DEAL

Elon Musk’s purchase of Twitter spattered on Tesla shares, which fell more than 12 percent on Tuesday, taking $100 billion (or “three Twitters”) out of market value from the company.

Which explains it: although it was a negative day for technology companies in general, Tesla has fallen much further. Much of the fall can be justified by musk’s model to finance the $44 billion transaction.

- Of the total, US$ 21 billion (about 10% of your fortune) should come out of your pocket. He did not detail where he will take the money, which opens up the possibility of having to sell part of his shares in the automaker. This could lead to instability in the negotiations of the company’s roles.

- Musk also got $25.5 billion in financial loans. Almost half of this will be tied to its ownership stake in Tesla, estimated at around $170 billion. The other part will be debt issues from their companies in the market.

- The billionaire and Morgan Stanley, who advised him on the lawsuit, are also probing other investors to help crack the bill the South African will have to pay.

See Elon Musk’s relationship with Twitter

Elon Musk, owner of Tesla and Space X, is the richest man in the world, according to Forbes. With a fortune valued at about $219 billion, he could become the first trillion-dollar brendan mcdermid in 2024 – 4.Apr 2019/ReutersMOREÂ

In numbers, Twitter shares fell 3.9 percent to $49.68, below the $54.20 offer, indicating a foot behind shareholders with the success of the deal. While Tesla, now worth $920 billion, is again leaving the group of companies worth $1 trillion.

Consequences: Amid the billionaire’s criticism of the social network’s moderation policies, the European Union has warned Musk that the platform will have to follow the bloc’s new digital rules. If you don’t walk the line, you may be fined or even banned.

- The new Twitter owner’s “anti-moderation” speech has also raised concern on the network’s employees. In addition to turning the work done so far into dust, they also fear that the portion of their remuneration into shares will be impaired.

- Another distress of the workers is whether Musk will repeat what he did with Tesla and move the company’s headquarters from California to Texas.

CAMERA DROPS BAGGAGE FEE

The House approved on Tuesday the end of the fee collection to check baggage up to 23 kilos on domestic flights and a suitcase up to 30 kilos on international flights.

The device was in one of the highlights of an MP (provisional measure) approved that loosens air sector rules. Now, the text needs to be approved by the Senate before it can be sanctioned. The validity of the MP runs until June 1st.

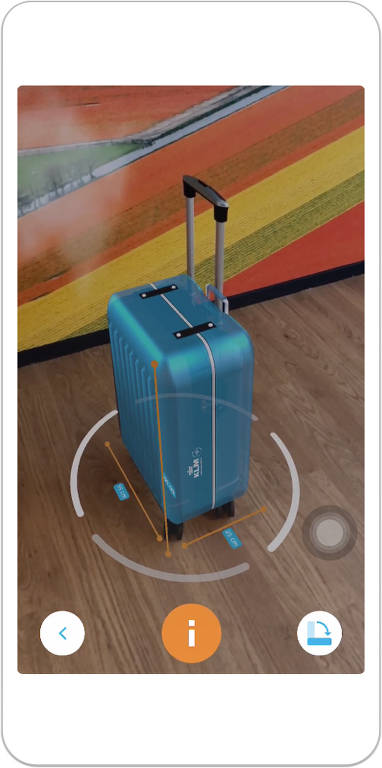

Apps that measure bags

Remember: the collection of the suitcase was allowed in 2016, when Anac (National Civil Aviation Agency) issued a resolution on the subject.

In 2019, Congress even overturned the additional fee, but the measure was vetoed by President Jair Bolsonaro and parliamentarians maintained the executive’s decision.

The MP:Â the basic text approved on Tuesday ends the need for concession contracts of airlines and releases the construction of aerodromes without prior authorization.

It even allows companies to bar unruly passengers for up to a year.

REGULATION OF OPERATIONS WITH CRYPTOS ADVANCES

The Senate approved on Tuesday (26) bill that has been called the “regulatory framework of cryptocurrencies”, for establishing guidelines on operations made with these types of assets.

The bill brings together different proposals that were being processed in the two Houses of Congress and needs the approval of the House before going to the presidential sanction.

What changes:

- The approved proposal provides that a government agency will have to authorize the operation, supervise and apply punishments to virtual asset brokers (exchanges).

- There is also a measure called “green mining”. It zeroes out import and commercialization rates for equipment used in crypto-related activities, as long as they only use clean energy. High fossil energy consumption in asset mining is a global problem.

- Cases of crypto fraud will have a specific criminal typification with penalties of four to eight years, plus fine. In crimes of money laundering and concealment of property, the penalties will be three to ten years in prison.

It’s not like that. At the time the Senate approved the bill that gave rise to the current one, experts heard by Folha said that obliging a government authorization to brokers operating in the country would have little effect on money laundering crimes.

They said the measure will hardly achieve the goal of preventing people from continuing to operate on platforms outside the country.

MARKET SEES SALTIER INFLATION

Market projections for inflation this year and next have risen sharply since the last Focus survey released by BC on March 28.

Since then, the agency’s servers have gone on strike, which has now been suspended for two weeks.

In numbers:

- IPCA: for 2022, the median increased from 6.86% at the end of March to 7.65%.. In next year’s projection, the advance went from 3.80% to 4%.” The current year inflation target is 3.50% and for 2023 3.25%, with a margin of 1 percentage point up or down.

- Selic: it is estimated to end at 13.25% this year, up from 13% in the March survey. For 2023, it remained at 9%..

- GDP: expectations are up 0.65% this year and 1% next year. In the last survey released, they were 0.5% and 1.30%, respectively.

Why it matters: with copom meeting knocking on the door (May 3 and 4), the market waits for new signals from bc in the face of the advance in inflation expectations for 2023.

- From this meeting, the authority begins to focus only on next year’s goal, considering the late effect of monetary policy.

- A rise in Selic from 1 p.p. next week to 12.75% per year is already given. The market is now waiting for an indication from the collegiate whether the cycle should stop there or go further – as most analysts project.